Views from the Industry: The Drone Industry Barometer 2019

Last year, together with INTEAERIAL Solutions, we conducted a Drone Barometer Survey to produce a free whitepaper with perspectives from the drone industry. The paper proved so popular and so many of you who attended the IAS conference asked for it again, that we decided to create a Drone Industry Barometer 2.0. Having gathered data from over 500 respondents from 74 countries, we now have broader and more thorough barometer results than ever before.

To address increasing demand and answer your calls for more views from non-European drone industry papers, we decided that this year the survey would be even bigger. This survey highlights a variety of challenges that the drone industry continues to face, as well as the changes in perspectives compared to 2018.

The Drone Industry Had a Difficult Year

Comparing last year’s perspectives to this year’s, drone companies had a much more difficult time than expected. While many predicted that this year would be fairly positive and strong for them, it turns out that many companies struggled to increase their sales and as such did not grow as quickly as they had anticipated.

Want to know more? Get our new Drone Industry Barometer Whitepaper!

-

Views from over 500 companies

-

Covering 74 countries

-

Outline of resource spending and priorities for the next year

Sales & Marketing in the Spotlight

More and more resources are being spent on sales and marketing. Survey results show major increases in company spending on improving sales & marketing apparatuses, while product development is getting allocated less money.

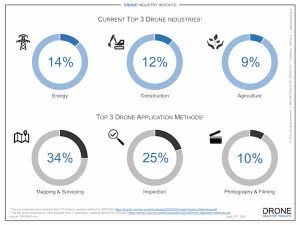

Mapping and Inspections Get Outsourced, but Surveying and Monitoring Do Not

We asked drone service companies to tell us for what purposes they use drones. Here we found out that drone service providers (DSPs) often handle tasks like mapping and inspections. Meanwhile, more operational tasks like surveying and monitoring stay in house and are mainly handled by internal drone services.

Check out our Drone Market Report 2019!

-

The global drone market will grow from $14 billion in 2018 to over $43 billion in 2024 at a CAGR of 20,5%.

-

Service is and will continue to be the largest segment of the drone industry, but software is the fastest growing.

-

Having legalized drones in December 2018, India will be by far the fastest growing commercial drone market in the world, by 2024 becoming the 3rd largest commercial drone market.

Regulators Don’t Make Life Easy

When asked to identify the biggest hurdles to their business, most companies pointed to regulations. Whether they are unclear, inconsistent or simply stringent, the current rules and regulations are causing difficulties for the drone industry.

E2E Solutions Are the Future

When asked about who the most important market-driving actors are, most companies listed E2E (end-to-end) solution providers. This is largely because their customers are increasingly seeking all-in-one drone solutions to fulfill their demands. As these companies continue to fine-tune their products, it’s clear to the drone industry that its future hinges on E2E solutions in order to outcompete traditional (non-drone) approaches.

Named one of the most influential people in the commercial drone industry by the Commercial UAV Expo, Kay established DRONEII as the leading drone market research consultancy after working for Lufthansa. As well as personally consulting on projects and producing reports, he frequently speaks at conferences, seminars and expos.

3 Comments